Have you ever been burned badly in the stock market before? Bought into a stock while it was all the hype and everybody around you – including your uncles and aunties – were raving on and on about it to the moon?

“You don’t want to miss out on this opportunity, bro,” your friend says with an assuring smile on his face. “The experts are very optimistic about it. See? It’s up almost 4,000% leh. Mai tu liao, wait any longer and when we’re all in our luxury villas, you will still be in that HDB of yours.”

“Huh, you sure ah?”

“Trust la, bro. I got ever mislead you before meh?”

“What about that time in secondary school – “

“Walan, you girl ah? So petty one? Let bygones be bygones la. Come, korkor show you how to buy…”

Only for it to nosedive sharply after you buy it, leaving you a nervous, unhinged mess as it continues merrily on its downwards trajectory?

I’ve been there. When I was an inexperienced and impressionable young adult, I lost a significant chunk of my savings to the merciless stock market. Actually, for transparency’s sake, it wasn’t the stock market that ate a majority of my savings but the crypto market.

Looking back, I had nobody to blame but myself. I was impulsive. I did not exercise proper judgement. And I was blinded by greed and promises of wealth beyond one’s imagination.

Still, while it was painful and entirely avoidable, it served as a lesson that I remember till this day.

To never try and time the market again.

Which is how I found out about a strategy known as DCA, or dollar cost averaging. I haven’t looked back since implementing this as my primary investment strategy.

In this post, I’ll be breaking down the concept of Dollar Cost Averaging, explaining its pros and cons, and how it compares to other popular investment strategies. All while keeping the explanations and terms used as simple as possible.

And if that’s still not truncated enough for you, there’s a TL:DR at the bottom of each section.

And if that’s still not enough for you, maybe investing isn’t for you.

What is Dollar Cost Averaging?

Dollar Cost Averaging refers to the act of investing at fixed intervals regardless of market conditions. At the most basic level, with stocks as an example, it’s just buying more of the stock you’re invested in the moment your monthly salary comes in.

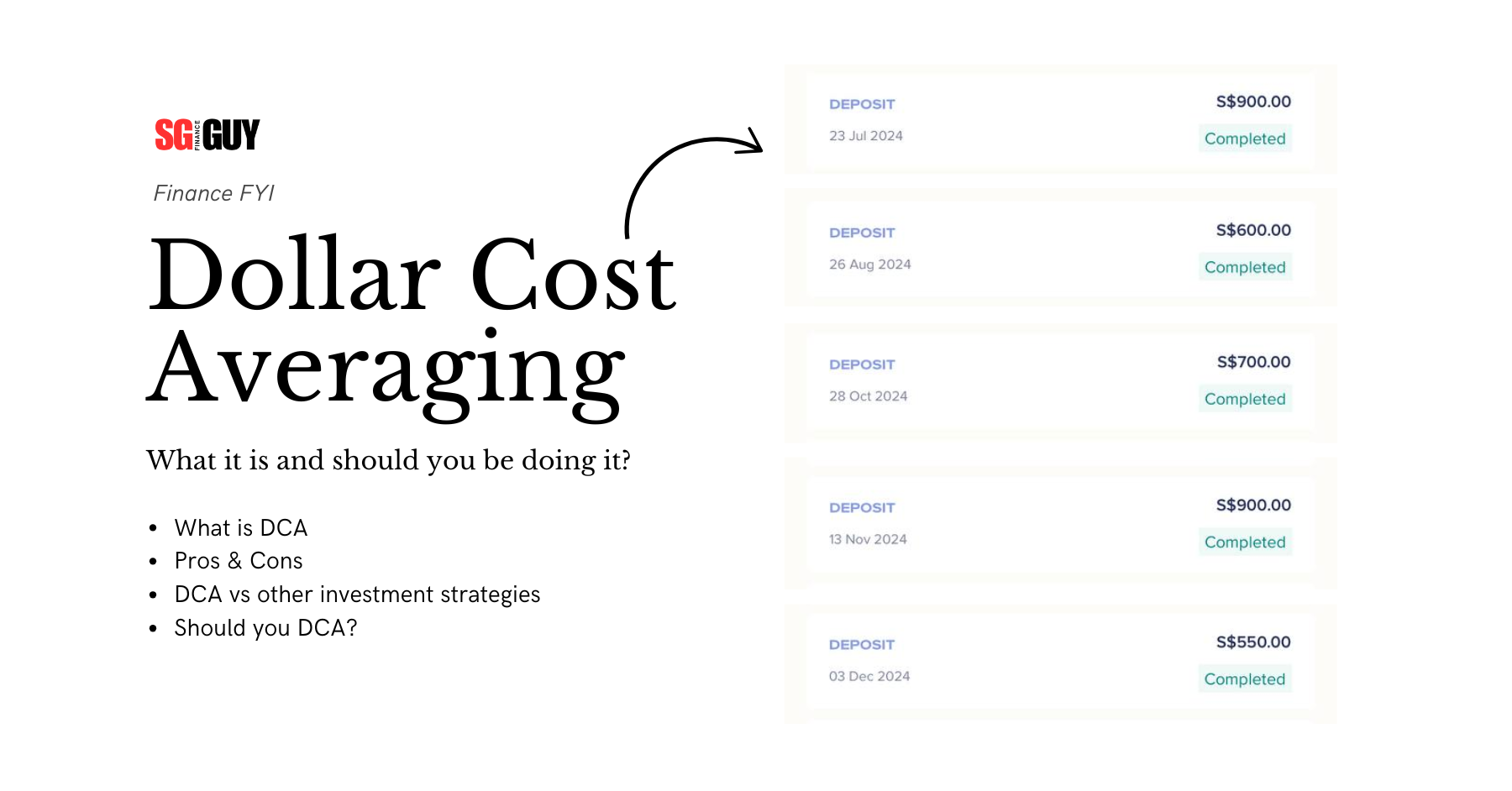

Let’s take me for instance. Assuming my pay comes in on the 1st of every month, I make it a point to deposit into my investment brokerage by the next day and subsequently purchase stocks at market price.

Rain or shine, I’m buying those damn stocks. It doesn’t matter if the market took a fat dump because the Feds sent a cryptic message about “not being where they want to be at” yet. It doesn’t matter if the market already rallied sharply because a mysterious masked individual with a moniker that rhymes with soaring city tweeted a couple of pixels.

I stick to the same ol’ strategy and pay no heed to what’s going on around me.

That’s Dollar Cost Averaging in a nutshell.

TL;DR: Dollar Cost Averaging is essentially investing consistently at fixed intervals without consideration of external market factors.

Why DCA?

Good question. Why should you consider this investment strategy?

Let’s start with the main benefits frequently associated with DCA-ing.

- Reduces Risk of “Timing”

Veteran investors will understand that investing is all about managing the delicate balance between risk and returns. Typically, the higher the returns promised, the higher the risk of that investment product.

And there’s no easy way to say it. Stocks are one of the riskiest asset classes out there. Some might say it’s second only to crypto.

This is where Dollar Cost Averaging can help. You eliminate one of the biggest investment risks right off the bat – timing.

Envision this. You happen upon a sizable chunk of money, be it through inheritance, a thirteenth-month bonus or every Singaporean’s wet dream, toto winnings. You don’t want to keep the money on hand. You intend to invest it all in one shot. This is known as lump sum investing.

With lump sum investing, which is essentially the antithesis of DCA, the timing of which you invest is of utmost importance. If you get in at the lowest point in the market, your returns will be exponentially higher than if you get in at the highest point. And since the markets are largely unpredictable, it’s mainly guesswork on whether a certain stock has hit a new high or bottomed out.

However, with DCA, you don’t face any of the above issues since you invest at a fixed interval like clockwork. You bypass all the time-consuming research needed to determine if it’s a good time to invest.

Also, you will find yourself averaging out the cost per share of the stocks you’re holding over the long run, typically leading to steady profits.

Insert poorly drawn image

P.S. This is not to say lump-sum investing isn’t a good strategy. More on this later!

2. Builds Discipline

Research shows that it takes an average of 66 days to build a habit.

Just like going to the gym or reading regularly, you should think of investment as something you want to make a habit out of.

Think about it – at their very core, the former two are essentially forms of investment as well. You put in your time and effort and get certain benefits such as confidence, knowledge and health in return.

Investing is for your financial health with a much, much more tangible and literal return on investment.

This might be more of an issue for investors who are just getting started, but staying disciplined to investing is criminally underrated. Once again, I’ll like to reuse the analogy I used above. Fitness junkies understand that consistency is key to achieving an aesthetic physique. This applies to almost every aspect in life, so why wouldn’t it be the case for investing as well?

Many people get cold feet the moment the market crashes. Once bitten, twice shy. While I understand it’s scary to put your money into anything that’s down in the dumps, this is where your discipline should kick in. Grit your teeth, and just do it. If you’re not going to skip a gym session when you’re having a shitty day, why are you not investing just because the market is feeling a little blue?

Dollar Cost Averaging really shines through in such cases. It’s simple to follow and you can stick to your strategy without much thought. It’s easy to be disciplined if you know you have a strategy that’s time-tested and historically proven to be highly effective.

The rewards are reaped by those who work hard (in this case, smart) and stay consistent.

3. Reduces Emotion

You know how in the wee hours of the morning, after a night out with your friends and a couple of drinks, you have the tendency of letting your emotions get the better of you? Alcohol lowers your inhibitions, intensifies your turbulent emotions, and… you end up making some truly questionable decisions.

Like texting your ex and asking for reconciliation.

Or caving in to peer pressure and agreeing to another round of drinks despite having made plans to go to JB early tomorrow morning.

Or selling all your crypto in the heat of the moment because you’re down 67% and your heart couldn’t take it anymore.

The last point may or may not require you to be under the influence of alcohol. Actually, on second thought, all of them are acts that can be committed dead sober. It just requires a lapse of judgement brought about by intense emotion.

Or mental impairment.

But I digress. My point is… emotion often results in bad decisions. We are humans, and humans are naturally emotional creatures. Even the most stoic of men will falter when confronted with large red numbers on their screens, knowing that they have lost a significant chunk of their savings.

It doesn’t help that the stock market typically follows a cycle of emotions starting with strong returns when optimism is high, and peaking with widespread euphoria. Then, a string of negative events shatter confidence and fear creeps in, resulting in mass sell-offs. The cycle then repeats itself when the dust settles and the markets slowly recover.

Insert image

The thing is, if you’re the typical investor and the chart above depicts your investment behaviour to the tee, I don’t need to consult a crystal ball to know that your returns – if any – aren’t ideal.

This is why DCA is viewed in such high regard.

Since you’re depositing and investing money at regular fixed intervals without caring about the state of the market, you’re not allowing your emotions to cloud your judgement. You don’t care if a media house publishes an article warning of a looming recession. You don’t care if a self-proclaimed investment guru predicts the energy sector to explode 5000% in the next 10 years.

You’re cool, calm and collected. You stick to your strategy. You buy more shares of the stock when the market is in the dumps and buy less shares when the market is near the peak.

Admittedly, the latter isn’t ideal, but it’s the trade-off you get for more stability – both financially and mentally.

And in a couple of years, because you stay invested and don’t get tempted to follow the majority of the market – essentially beating it – you will most likely be in profit.

Insert image

Always remember this famous saying by the Godfather of investing, Mr. Warren Buffet…

Be fearful when others are greedy, and greedy when others are fearful.

DCA is pretty much the ideal strategy to employ to achieve that with minimal effort on your end.

Now that I’m done waxing literal poetry and singing praises about DCA, let’s move on to the cons. Yes, unfortunately, there’s no “perfect” investment strategy and while I believe DCA comes as close as possible to perfection, there are still some drawbacks you should be aware of.

- Higher Transaction Costs

The most obvious downside of DCA-ing is the transaction costs you’ll incur making the stock purchases on such a regular basis versus a one-time transaction. Most brokerages charge some sort of fee to buy a stock through them, be it platform, trading or commission. This could be a flat sum or a percentage-based cut, depending on the amount you’re trading. On top of this, there are other “hidden” fees such as fx (currency exchange) and spreads – all of which accumulate and add up over a long period of time.

- F*cks Asset Allocation

Diversification is the name of the game. All big-name investors swear by it (crypto doesn’t count, I don’t particularly care for crypto billionaires who got lucky hedging their life savings on $SHIBA) because it helps to lower risk.

Some people diversify by buying different companies. Some people take it a step further by buying different companies in different industries. Some people take it two steps further by buying different companies in different industries across numerous geographies.

And on top of all of that, you can take it another step further by buying and investing in different asset classes (on top of the commonly traded stocks, known as equities or securities), such as bonds and properties.

Now, a good example of a diversified portfolio with different asset classes is Ray Dalio’s All Weather Portfolio.

Insert image

Not going to talk too much about this as this is another topic altogether, but note how there are different allocations to each asset class?

DCA makes it hard to stick to this allocation as you’ll need to deposit a specific percentage of your availing funds into each asset class whenever you decide to make a deposit. And… well, unless you’re depositing a crazy sum of money each time, there will be problems. We’re talking inability to meet minimum investment sums, high fees, ever-changing hoops and criterias to qualify…

The list goes on and on.

- Lower Expected Returns

Now, as a DCA believer, this fact blew my mind. I fact-checked it a total of 3 times to ensure it was accurate, and it hurts me to say so, but it is.

DCA has historically underperformed lump sum investing. According to Vanguard’s research, from 1976 to 2022, lump sum investing would have outperformed DCA 68% of the time.

The reason is extraordinarily simple.

The market is more often in a bull run (on an upward trajectory) than it is in a bear run. To be exact, bull markets last for an average of 6.6 years. Bear markets, in comparison, only last for an average of 1.3 years.

Since that’s the case, if you ever do lump-sum investing, you’re statistically more likely to deposit in a bull market than a bear market, which will yield you more gains as compared to spreading out your investment over an extended period.

Is there a superior strategy?

The million dollar (quite literally) question. Which investment strategy is better?

Now, having done marketing at a fintech firm for a period of time, I understand the importance of disclaimers. This is exactly where I should be telling you that what I’m about to say is strictly my opinion and my opinion only. It should not be construed as financial advice in any shape or form. Do your own research or consult a qualified financial advisor.

With that and a potential lawsuit out of the way, here’s my two cents.

There’s no such thing as a perfect strategy. Yeah, I know, I know, that’s the most generic statement ever, one repeated by investment firms and finance experts all over the world. But it’s true.

The superior investment strategy depends on a multitude of factors, including but not limited to:

- Your investment horizon

- Your risk tolerance

- Your investment goals

- Your sensitivity to market fluctuations

- Your desired asset allocation

The list goes on and on. Ultimately, it’s really up to you – every strategy has its pros and cons after all. It’s just which one will better suit your needs and make it more convenient for you to invest.

However, rather than leaving it as that like most other finance blogs do, I’ll like to present a couple of scenarios featuring different investment strategies to paint a picture that could be easier for you to understand.

There are 4 friends: Ah Beng, Ah Seng, Ah Lian and Ahmad. They all decided to start investing at the same time with a total deployable capital of S$100,000 each.

Ah Beng recently moved into his new BTO with his secondary school sweetheart. With a loan to repay and plans to have kids soon, Ah Beng understands that liquidity is important as he might need money in the near future if some unexpected expenses pop up. It will also help to pay for his siamdiu escapades. Because of this, he decides to DCA his capital into the S&P500 at $10,000 every year for 10 years.

Ah Seng is your typical high-flying insurance agent. He leads a bachelor’s lifestyle and has no plans of settling down in the near future. He has a steady stream of income from his job and is confident that he won’t ever need to touch the $100,000 in the next couple of years. He decides to invest the entirety of that sum into the S&P500 in one go.

Ah Lian has no clue what investing is. She has also heard lots of horror stories from her friends who have lost hundreds of thousands in crypto and believes that investing is bad. However, her second boyfriend works as a financial advisor and insists that she shouldn’t be keeping her $100,000 in cash as it depreciates every year due to something called inflation. She relents but being the kiasi queen she is, she firmly states that she refuses to invest in anything remotely risky. The $100,000 was subsequently invested in SSBs, otherwise known as Singapore Savings Bonds.

Ahmad doesn’t know why he’s in this friend group in the first place. He has a sneaking suspicion his sole purpose in this friend group is to prove a point of some sort, but he’s most likely just imagining things. One thing he knows for sure though is that his luck is terrible. Whenever he buys a stock, it immediately plummets. Whenever he sells a stock, it immediately rises. However, despite being gan suey, he still invests because he’s what the Gen Z’s call a gigachad. He also employs the DCA strategy by investing $10,000 every year over 10 years, but the difference is he only buys into the market at the highest point each year.

Here’s how their returns look after 10 years.

Insert Graph

It might not come as a surprise that Ah Seng had the best returns among the four. After all, lump sum investing outperforms DCA 2 out of 3 times and the difference becomes more and more apparent the longer the time period. Ah Beng, however, with his DCA strategy, wasn’t actually that far behind.

Ah Lian had the worst returns by a long shot. It’s just how investment works – high risk, high returns and in this case, low risk, low returns. At least it’s still better than keeping it in cash – the value of the initial $100,000 would have dropped to $82,000 at the end of the 10 years, assuming an average annual inflation rate of 2%.

Perhaps unexpectedly, for all his bad luck, Ahmad actually didn’t do that much worse than Ah Beng. This simply shows it pays to be invested and time in the market is better than trying to time the market.

Fun fact: If you missed out on just 5 days during a bull rally, you potentially stand to lose 20% of gains.

So… let’s wrap it up.

Regardless of the investment strategy you choose to employ, most of them will still pay off in the long run as long as the strategy involves you keeping your money in the market. The only difference is how much returns you get, but as shown in the example above, it actually isn’t that big of a difference.

At the very least, it’s not significant enough for you to spend a huge chunk of time fretting over. Stick to the fundamentals, and you’ll be fine.

Just remember that building wealth isn’t a sprint, but a marathon. The stock market is a battlefield, and time is your biggest ally.

Until next time!

Stay safe, stay healthy and stay invested.