Hey folks, welcome to my first entry in my personal investing series, DIT1M. It might sound like a typical gamer tag, but no. DIT1M actually stands for Dividend Investing to $1 Million. Armed with nothing but a handful of investing knowledge from working in fintechs and my ever-reliable Googling skills that has served me well thus far, I’m going to try and make that a reality.

Ideally before I reach 45 too, which leaves me with… 15 or so years.

Yes, you now roughly know how old I am. My god, the dreaded 30 is lurking around the corner.

But you’re not here to listen to me go on about my quarter(ish) life crisis, mounting back pain and growing obsession towards marathons.

Let’s get straight into the juicy stuff, starting with how my portfolio did in 2024 in relation to the broader market followed by a comprehensive breakdown of my dividend payout, buys and stock allocation.

The Stock Market in 2024

Truth be told, I don’t remember anything truly big going down in 2024.

But maybe that’s because it was another stellar year for the stock market and we only tend to remember the bad.

The S&P500 grew 25% in the 2024, fuelled largely (once again) by AI innovation and the Magnificent 7, though other factors like the resilient US economy and the Feds finally lowering interest rates also played big roles.

This makes it 2 consecutive years of 20%+ growth for the S&P500.

So… when the entire index goes on a fantastic run, my portfolio is naturally up as well.

But how well did it do exactly?

My S$30k Dividend Portfolio Performance

I’d say it did pretty decent, considering how risk averse I was with my stock picks.

Let’s start by taking a look at how much it grew in 2024.

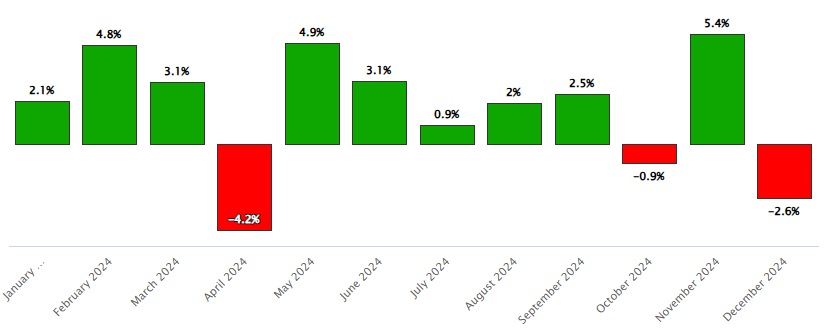

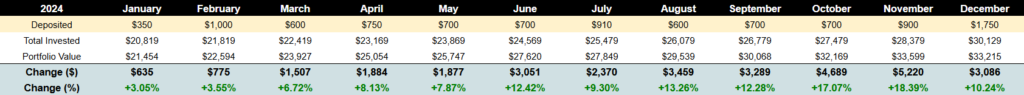

As you can see from the table above, my portfolio returned me 10% in 2024. It was up 18% at one point in November, but it quickly shed those gains and closed the year lower.

Comparatively speaking, it’s nothing to write home about. After all, the S&P500 registered a 25% return – what’s 10%?

But that’s not a fair comparison. Dividend-paying stocks typically don’t appreciate in value as much as others. To evaluate my dividend portfolio’s true performance, we need to measure it up against similar dividend stocks.

Let’s take the Dow Jones U.S Dividend 100 Index as the benchmark. As an index that tracks the performance of 100 high-yielding U.S dividend stocks, DJUSDIV returned approximately 16.62% in 2024.

That’s still better than what I managed with my portfolio, but at least not 2.5x better like with the S&P500.

Still, disclaimer: I’m entirely fine with my mediocre returns. I knew from the get-go when I started this dividend journey that I will never reach the heights of the S&P500. That’s just the trade-off of investing in stable and boring blue-chip dividend stocks.

Now, moving on to the juicy bit – the actual dividend payout.

How much did I earn in dividends?

The million dollar question. How much did I earn in total from my S$30,000 portfolio?

Before I disclose the amount, I think it’s important to note that I didn’t actually start the year with S$30,000. I started the year around the $22,000 mark and DCA’d myself up to $30,000. So the amount I received in dividends is not exactly from a S$30,000 portfolio. It’s just what I’ve accumulated over the year as I worked my way up towards that amount.

Anyway, drumroll please…

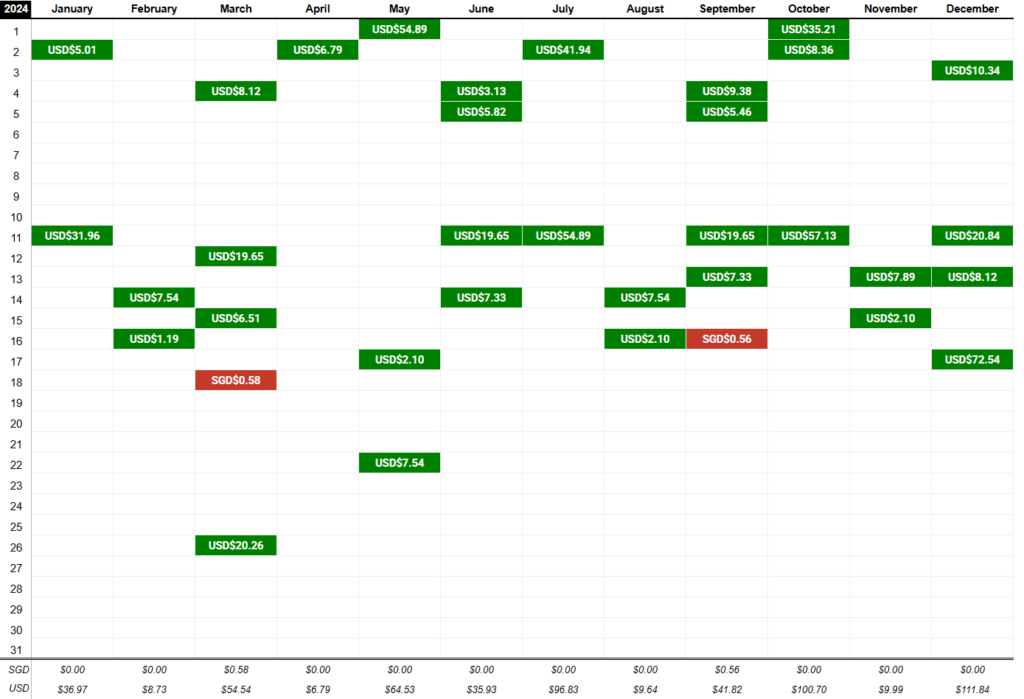

I made a grand total of US$297.34.

That’s almost SGD$400. I can’t live off of it yet (obviously), but it’s a pretty good amount considering how small my portfolio is!

So, this begs another question. What’s the dividend yield on my portfolio?

For the folks who are new to this, dividend yield is essentially

For simplicity sake, let’s convert my dividend payout to SGD and round it up to S$400. Coming from a $30,000 portfolio, that translates roughly to a dividend yield of 1.33%.

Which to be honest, is pretty bad.

There are two reasons behind this absurdly low dividend yield.

- Dividends from US stocks all have 30% withholding tax. This means that if a US stock you own pays out $100 as dividend, you will only receive $70 – the remaining $30 goes back to the US government as tax.

- A couple of stocks I own have very low dividend yield, lowering my overall dividend yield even further.

Stock Breakdown

- Intel Corporation (INTC)

Number of Shares: 72.037

Invested Amount: $2,022.80

Current Value: $1,768.50

Change ($): -$254.30

Change (%): -13.58%

Dividend Received:

Starting from my smallest holding by current value – or let’s not beat around the bush here, the biggest loser in my portfolio – we have Intel.

The storied chipmaker from America was once the hallmark of American ingenuity and manufacturing. Intel used to be the biggest provider of semiconductor chips in the world. The crown jewel of America, miles ahead of everyone else with their cutting-edge technology and speed of innovation.

(cue eagle flying gracefully overhead amidst a blaze of gunfire)

The chip manufacturer is now but a shell of its former self, down having fallen far behind competition in recent years. It has plummeted 65% in value from $68 per share since the COVID-induced highs back in 2021.

Unfortunately for me, this translates into into a red smudge in an otherwise sea of green in my portfolio. I don’t want to go too deep into my rationale behind buying this stock. And even if I wanted to, I honestly do not remember. I was more of a “*vibes” *****investor back in the day (it was probably about 2-3 years ago) and Intel was a big name producing chips used in electronics. That was good enough for the past me.

Anyway, I thought that this serves as a reminder about the harsh reality of investing. Not every stock you buy will go up in value, even if it’s a blue chip stock.

Also, I’m in an awkward position because Intel recently announced that it will suspend dividends until further notice. Technically, it doesn’t qualify as a dividend stock anymore, and hence shouldn’t be part of my dividend portfolio.

I have decided to sell all my shares in Intel and reinvest them in either my existing stocks or a new dividend stock so as to maintain the integrity of my dividend portfolio. More on this in my next update!

- Apple Inc. (AAPL)

Number of Shares: 8.3935

Invested Amount: $1,399.95

Current Value: $1,888.53

Change ($): +$488.58

Change (%): +34.95%

Dividend Received:

Good ol’ Apple.

As one of the Magnificent 7 who performed outrageously well in 2024, it should come as no surprise that it was one of the biggest winners in my portfolio.

Now, I was an ex-Android user. I caved around 5 or 6 years ago and bought an iPhone due to peer pressure. I wanted to find what the hype was about.

You should know how the story goes. Once I made the switch, I never looked back.

As a loyalist myself owning multiple Apple gadgets, I’m confident in their ability to acquire and retain customers. I believe in their branding and the incredible moat they have against competitors. And don’t even get me started on their genius ecosystem designed to lock you in for good.

The only “downside”?

As far as dividend stocks go, it has a pitiful dividend yield of 0.46%. This meant that I only received $XX in dividends despite holding almost $2,000 worth of it.

I’ll do a deep-dive into Apple stock in the future, but I’m willing to overlook that as it’s still a tech company and needs money for R&D. I’m actually surprised it even pays dividends in the first place, but I’m not complaining.

I foresee myself buying much more Apple in 2025 and holding it for the long, long term.

- The Coca-Cola Company (KO)

Number of Shares: 30.709

Invested Amount: $1,839.24

Current Value: $1,934.38

Change ($): +$95.14

Change (%): +5.17%

Dividend Received:

Fun fact: Coca Cola is Warren Buffett’s favorite soft drink. He drinks 5 cans of them a day. Yes, every f-ing day.

Gentle reminder that he’s 95 years old this year.

His adoration with the beverage doesn’t end with just consumption though. He also owns 400 million shares of the company itself. That’s a whopping 9% of Berkshire Hathaway’s entire portfolio and its 4th biggest holding.

If this sugar-laden carbonated drink has Warren Buffett’s vote of confidence… let’s just say that I’m not about to go against his better judgement.

Also, I think it’s worth pointing out that by buying shares of KO, you’re not just investing in that singular beverage. The Coca-Cola company has acquired tons of brands and currently own an impressive portfolio spanning across different beverage categories. Some examples are Costa Coffee, Minute Maid, Sprite, Fanta, Dasani… You can find the full list here on their website.

You’re not only putting your trust in a single beverage. You’re betting on pretty much the entire beverage industry with one investment.

Admittedly, its performance in 2024 wasn’t the best. It depends on the time frame you look at since it gained almost 20% at one point before tumbling down towards the end of 2024. It was a lackluster year overall, but that’s how the cookie crumbles.

Still, I believe in the company and will continue stocking up on it in 2025.

- ExxonMobil (XOM)

Number of Shares: 21.049877

Invested Amount: $2,039.86

Current Value: $2,483.04

Change ($): +$443.18

Change (%): +21.7%

Dividend Received:

ExxonMobil is a global provider of energy, specialising in fossil fuels and natural gases.

I’ll leave the boring history lesson out, but this giant of the oil and natural gas industry has an interesting backstory, having lived and flourished through all of the world-altering events in recent history. Wars, recessions, political conflict… ExxonMobil has stood tall through it all.

And in my opinion, that’s the biggest vote of confidence any company can ever get.

Deep connections and deeper pockets aside, you might be wondering… if this company is so damn big, why haven’t you heard of it before? Well, here’s the thing – you probably have. It operates in Asia too, just under a different trading name.

Esso.

Yep, that iconic petrol kiosk.

Another reason I continue to invest into this stock is its absurdly high dividend yield. As of writing, it’s a whopping , contributing to XX% of the total dividends I received in 2024 despite only accounting my for less than XX% of my portfolio.

I didn’t buy aggressively into it in 2024 because it reached all time highs and there were other bargain buys, but I will be adding more XOM in 2025 for sure.

- Visa Inc (V)

Number of Shares: 9.0059

Invested Amount: $2,191.94

Current Value: $2,837.58

Change ($): +$645.64

Change (%): +29.46%

Dividend Received:

Another big name on this list. Visa needs no introduction, and the electronic payment provider has a business model that other companies on the S&P500 can only dream of.

Due to the nature of their business, Visa has an incredible 50%*~ net profit margin. In comparison, Microsoft (with SaaS as some of their main product verticals) has about 35% while Apple trails behind with about 25%. This profit margin is almost unheard of, and also one of the primary reasons why I’m such a big believer in Visa. At the end of the day, a company’s primary purpose is to generate profit and Visa is damn good at it.

Dividends-wise, Visa returned me a total of $XX in 2024 at a dividend yield of XX%. Pretty decent by all counts.

*Net profit margins stated are as of 30/09/23

- Altria Group Inc. (MO)

Number of Shares: 56.81067

Invested Amount: $2,444.56

Current Value: $3,280.24

Change ($): +$835.68

Change (%): +34.18%

Dividend Received:

As far as dividend stocks go, Altria Group is one of the most popular out there due to its amazing yield. However, I don’t think it’s a household name and might need an introduction.

The product that they produce needs no introduction though.

Rokok la.

Altria Group is one of the industry leaders in tobacco production. Marlboro and Black & Mild in particular stands out in its stacked portfolio.

I used to smoke. I am painfully aware of how addictive cigarettes are. Anything with nicotine in them, really. Pair that with how smokers are some of the most price-insensitive individuals out there and you have a winning formula.

But, the real reason why people are going bonkers over this stock is its dividend yield.

I currently have 56 shares of Altria, valued at $3,280. I have generated $XX worth of dividends from it, which is a mind-blowing yield of XX%.

The average yield of dividend-paying stocks in the S&P500 is XX%.

That’s XX% more.

So yeah. What’s there not to love about Altria?

I do want to clarify that I do not endorse smoking in any way. It can and most likely will negatively impact your life. However, if you’re already a smoker, consider switching to Marlboro to support my investment.

- Microsoft Corporation (MSFT)

Number of Shares: 9.777958282

Invested Amount: $2,745.94

Current Value: $4,140.57

Change ($): +$1,394.63

Change (%): +50.78%

Dividend Received:

Microsoft is the most self-explanatory stock in my portfolio. It’s the proverbial poster boy of the stock market after all.

And for very, very good reason.

Microsoft ticks off every box possible when it comes to looking for a stock to invest in.

Outstanding financials? Check.

Flush with cash? Check.

Great products? Check.

Clear roadmap into the future? Check.

Best gaming console? Yeah… maybe not.

Still, we all rely on Microsoft in one way or another. You’re either reading this on a device powered by the Windows OS. Or you find yourself using Microsoft Office in your school or work. Or perhaps you have a screw loose and enjoy browsing the net on Microsoft Edge with Bing as your default search engine.

The fact that it pays dividends is just the cherry on top.

Yes, admittedly, it’s a small cherry… I only received XX in dividends despite it accounting for more than 20% of my portfolio’s value.

But we all know size doesn’t matter. And come on, what do you expect from a company called Micro–soft?

… yeah, not my best joke. Let’s just move on.

- Schwab U.S. Dividend Equity ETF (SCHD)

Number of Shares: 210.4516

Invested Amount: $5,566.44

Current Value: $6,214.63

Change ($): +$648.19

Change (%): +11.64%

Dividend Received:

SCHD is – dare I say it – the most popular dividend ETF in the market. Why?

Well, I can think of three big reasons.

- It has a stellar track record of double-digit annualised returns.

- It has never failed to deliver dividend growth year-on-year.

- It has a low expense ratio of 0.06%.

But let’s take a step back. What even is this SCHD ETF?

SCHD tracks the Dow Jones U.S Dividend 100 Index which comprises the top 100 US stocks with strong fundamentals and a track record of paying out dividends for a minimum of 10 consecutive years.

Some examples of companies this ETF tracks are Blackrock (BLK), Chevron (CVX), Verizon, (VZ) and Ford Motor (F). The full list can be found here on Schwab’s website.

Realistically speaking, I’m never going to be perfect with my stock picks. Some of them are going to flop regardless of how infallible they seem on paper. SCHD is my hedge against the unpredictable market in my dividend portfolio.

Imagine this scenario. Say Altria Group goes to zero overnight because they declared bankruptcy. Yes, I touched every wooden furniture I could find after typing that sentence. In that hypothetical scenario, I’d lose every penny I invested into Altria. And if I had put all my eggs in that proverbial Altria basket, I would have lost everything.

Everything.

This is where diversification helps with risk control. As mentioned above, SCHD tracks an index which comprises of the top 100 US dividend stocks. Even if Altria crashes and burns, it’ll only go down slightly since there are 99 other companies that are still going strong with their valuations.

In addition, there are certain months where I can’t decide which stock to DCA into because every stock might seem overpriced. SCHD is my default fallback during those months; you can never go wrong with diversified ETFs.

Yeah, that’s why it’s my biggest holding. And honestly, I don’t see that changing anytime soon.

My Investment Strategy For 2025

2025 is only a month away, and I have already started thinking about what kind of changes I should make to my portfolio.

At the moment, I’m leaning towards two major changes.

- Diversify, diversify and diversify even more

Change is the only constant in life. This bitter pill to swallow applies to one’s portfolio holdings as well.

With unprecedented geopolitical tensions and whispers of recession, I’m looking into other ways to protect my investments. But the main reason why I’m set on this is mainly due to how I’m too heavily invested in the US. With another Trump presidency comes another wave of radical and somewhat questionable economical policies, and let’s just say that I believe it’s the perfect time to diversify regionally.

And one actually doesn’t have to look too far from home for such diversification opportunities.

Yes, I’m talking about investing in Singapore stocks listed on the Singapore Stock Exchange, or SGX.

… put away those pitchforks. Let me explain.

The Singapore stock market is famous (or infamous?) for trading sideways with less than stellar growth over the years. As of time of writing, it has just recovered from the COVID-19 induced panic selling in 2020 which resulted in a decline of 31% from previous highs.

source: sgx.com

It’s been 4 years. And we’ve only just recovered.

All things considered, that’s about an average of 8% per year. Compared to the Nasdaq or NYSE, which capture gains averaging 15% and 11% respectively, it’s quite obvious to see why SGX isn’t typically at the top of an investor’s list.

The thing is… I’m not looking for growth. Well, at least not explosive levels of growth with companies like Tesla or Nvidia. I have other portfolios and allocations for growth stocks.

I’m looking for safe dividend stocks I believe have some growth potential and a proven business model that enables it to keep raking in cash for at least the next decade.

And you might be surprised how many stocks in Singapore tick all those boxes.

I’ll go into more detail regarding this when the time actually comes around, so stay tuned!

- Keep more cash on hand

Truth be told, I have almost no cash on hand.

It’s the best time to change that.

I believe buying opportunities will present themselves in abundance come 2025. It could be with certain stocks being battered down due to a poor quarter, or the broader market selling off after the publication of a piece of negative news. Having cash on hand would allow me to capitalize on those dips and grab stocks at a hefty discount.

It’s always the best time to buy when fear is at an all-time high.

And whilst my investment strategy revolves around DCA-ing at a fixed time every month (which I will still commit to), having some cash ready to additionally deploy at a moment’s notice is a great way of lowering the average price of the stocks you hold.

Questions & Answers

Onto the question and answer portion! These are some questions I expect to emerge when first reading this series, or even when you first visit my blog. If you have any other questions, either leave them in the comments below or reach out to me directly via my contact me page.

Why 1 million?

It’s a nice round number and has a nice ring to it. Yes, I’m superficial like that.

Okay, but seriously. For most people, without proper planning and a sound investment strategy, a million sounds like a far-fetched dream. I want to prove that it’s actually possible for even the most average Singaporean as long as you’re financially savvy and invest smartly.

But lastly – and most importantly – having a million as investment capital allows you to live quite comfortably off the payouts. I will only be buying dividend stocks in this series, which as you know, pays dividends. Even with a very conservative estimate of an average 3% dividend yield across all the stocks I hold, it will still payout a respectable 30k a year. (I know that I’m not taking into account withholding taxes, but this is just an example)

Would that amount be enough to survive off in 2040 with how fast inflation is pushing the cost of living up? I honestly don’t know and I wouldn’t worry about that for now.

Why Dividend Investing in particular?

There are many reasons. But, as a TL:DR…

1. It’s relatively safe… as far as stocks go. This primarily comes down to my choice of dividend stocks to invest in. I only buy into high-quality companies with a long-standing history of dividend payouts, proving that they have good business fundamentals and healthy finances.

2. I love the idea of reaping your rewards. With traditional growth stocks that don’t pay dividends, the only way for you to “realise” your profit is to sell the stock itself after it has grown in value. You can hold onto dividend stocks and never sell and still enjoy profits in the form of dividends.

3. It allows me to be very hands-off with investing. Because I don’t ever have to sell my holdings to realise my gains, I don’t have to scrutinise the market on a daily basis, trying to capture the best selling or buying opportunity. I sleep like a baby every night without worrying about market fluctuations.

4. The snowball effect is on full display. You can really see your investment portfolio grow exponentially as you consistently reinvest your dividends. This is definitely more mental than anything else, but it feels good to see that you’re making good progress.

There are some other points that are more technical which I explore in my Dividend Investing 101 post, so go through that if you’re keen on finding out more about the pros and cons (yes, there are still cons) of dividend stocks.

Do you only buy dividend stocks?

I do not. I’m a big advocate of diversifying your investments. It’s the key to risk management. You do not want all your eggs in one basket – the collapse of just one industry or financial institution could wipe you out.

I hold some other asset classes, mainly bonds, crypto and fixed deposits. But stocks remain the bulk of my holdings since I can afford to take on more risk due to my age. And within my stock allocation, I mainly buy into stocks or ETFs that pay dividends.

For the sake of this series, to avoid confusion, I will only be covering the growth of my dividend portfolio in particular and nothing else.

What will this series entail?

It’s mainly going to be monthly updates on my dividend investing journey. Expect details like how my portfolio is doing broken down stock by stock, my dividend payout for the month (if any) and how the market is doing & corresponding plans to navigate it.

Still, I want to put it out there that I foresee occasional lapses in updates.

I’m going to be DCA-ing a portion of my salary on a monthly basis and if it’s not painfully obvious yet, I’m not Elon Musk and don’t command a multibillion dollar pay package. With limited buying power and only a handful of preferred dividend stocks, the content I can push is naturally somewhat limited.

Investing was never meant to be flashy after all.

This means I might skip over certain months if there’s nothing significant to report on. We’ll see how things develop as they go.

Will you be giving stock recommendations?

Walan eh. Don’t get me in trouble leh.

I’ll state it upfront. It’s a firm and resounding no.

If you’re here looking for stock recommendations, you’ll have better luck searching for a tacky “Top 10 Stocks to Buy Now” article from The Motley Fool or Yahoo Finance.

I will never recommend a certain stock. Period. I’m going to write and document my investment journey in its entirety, which inevitably means that certain stocks will be mentioned. I might even do a stock review or multiple reviews at some point. Regardless what the content might be, they shouldn’t be taken as recommendations.

Everything I write is my opinion and my opinion only. It shouldn’t be construed as financial advice in any shape or form. I’m fully aware of the risks pertaining to investment and still choose to do so because I believe the pros far outweigh the cons. However, it could be different for you. Make sure to do your own research and fully understand the risks before dipping your toes into investments.

What’s your career and what industry are you working in?

I do Marketing in the tech industry.

What’s your salary?

I reveal this and more in my Financial Breakdown series.

This wraps it up for the first ever DIT1M post! Feel free to leave any other questions you might have in the comment section below. Stay safe, stay financially savvy, and above all, stay invested.

Until next time. Cheers.