Aloha! Welcome to the second episode of Dividend Investing to $1 Million!

It’s May already. Time flies, huh?

Yes, I missed 3 updates in February, March and April. Yes, it’s not a good start to this series. Yes, I’ve been absurdly busy. Yes, that’s not a good excuse. Yes, I am sorry and I will strive to be more consistent.

So… now that we’ve established that I don’t have the best relationship with consistency, wanna hazard a guess who else seems to struggle with the same issue?

The US market.

In a mere span of 4 months, we saw the market sentiment go from high confidence and rosy forecasts to extreme fear and multiple recession warnings.

It’s a wild rollercoaster ride. And I absolutely detest rollercoasters.

The worst part is how this is likely only a taste of what’s to come.

Second Season of Trumponomics

Season 2 of Trumponomics did not get off to a good start.

The market’s wild fluctuation is largely a result of Trump’s unorthodox economic policies. Liberation Day introduced reciprocal tariffs starting from a minimum of 10% on every country it traded with. Tariffs of this scale, dubbed the “worst case scenario” by some economists back in March when nothing was concrete yet, shocked global markets and led to significant downturns.

In the days since, the situation has further escalated.

Trade between China and US – the two largest countries in the world by GDP – has effectively come to a standstill after a back-and-forth rally of tariff increases. The relationship between these two global superpowers is clearly strained as both countries refuse to budge an inch. Of course, since things are developing at such a breakneck pace, news have surfaced regarding a possible meeting between their respective delegates at Geneva, Switzerland while I was drafting this article.

Fingers crossed it goes well!

But my point is… things are not going too well for Trump in his first 100 days.

Even Japan, a key US ally, has openly criticized Trump’s tariffs. Japanese Prime Minister Shigeru Ishiba stated that negotiation between the two countries cannot proceed unless the tariffs were immediately abolished, labeling the tariffs as a blatant act of delinquent bullying.

And despite the Trump administration’s insistence that the phone has been “ringing off the hook” with countries desperate to make deals and how there would be “90 deals in 90 days”, the US has only managed to sign one deal with the UK after 40 odd days. And to herald it as a great deal like what Trump’s cabinet has been doing would be somewhat of an exaggeration because frankly, it’s not.

And because I had to subject myself to hours and hours of Trump talking while keeping myself informed of such news, I would like to share the sheer joy of it with you as well.

Just give the video below a watch. Truly unprecedented stuff. Trump never ceases to amaze me.

But I won’t be getting too deep into my thoughts about Trump’s presidency thus far. I’m no subject matter expert and I’m not knowledgeable enough.

So let’s stick to what I do know, like my stock purchases over the last few months.

My Stock Purchases

I stocked (haha, geddit?) up on a number of stocks over the past couple of months as the S&P500 shed approximately $9.6 trillion in value.

And also let go of one entirely.

But let’s not jump the gun here and go month-by-month.

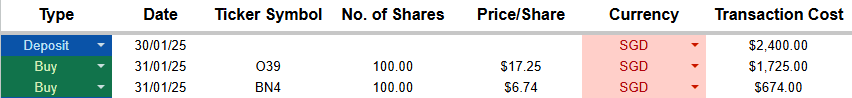

Let’s start with my transactions in February.

I deposited S$2,400 and used some leftover cash within my account to fund my two SGX purchases in OCBC (O39) and Keppel (BN4). I was determined to keep to my strategy this year of diversification so I figured no time like the present. I specifically picked these 2 stocks because they have strong financials and high 12m dividend yields – OCBC at 5.25% and Keppel at 4.99%.

At the end of the day, we’re talking about Singapore stocks in SGX, infamous for trading sideways. I might not get much capital appreciation (especially with Keppel, OCBC should be fine), but I’ll get paid out a decent amount of dividends at the very least. And anyway, I also have to bear in mind that this move isn’t so much to maximize returns, but to help reduce my overall exposure to the volatile US markets.

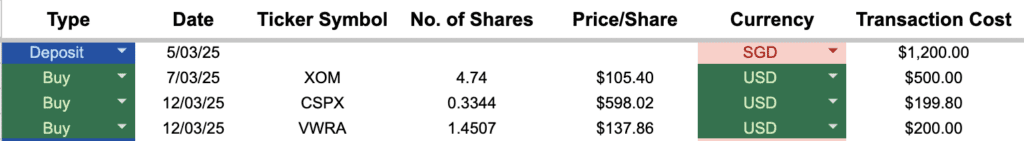

And in March, I did something new.

I started buying ETFs listed on the London Stock Exchange, which are more tax efficient. Without getting too deep into the details, I pay lesser taxes on the dividends received from these ETFs (15%) as compared to ETFs listed in the US (30%). For a dividend investor like me, this is a big deal in the long run as my investments will compound faster.

These ETFs are CSPX and VWRA. The former tracks the S&P500 and has a 12m dividend yield of 1.51%, while the latter tracks equities across the globe, including both developed and emerging markets, and has a 12m dividend yield of 2.16%.

I’m making it a point of investing US$200 into each ETF every month. Whatever remains will go into individual stock picks. VWRA will help me diversify even further since I now have exposure in global markets, and CSPX is just to help out with dividend tax efficiency.

I dumped my remaining US$500 into Exxon Mobil.

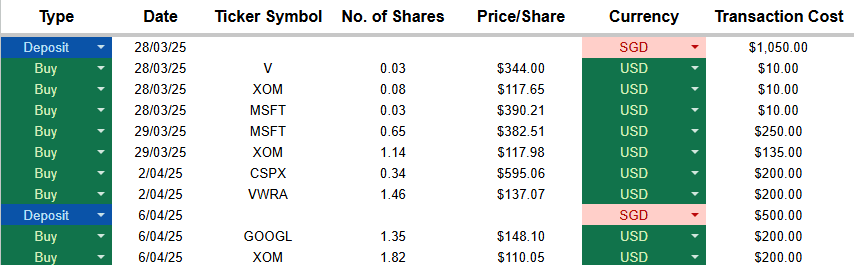

April started off pretty wild.

Liberation Day tariffs were announced on the 2nd of April, which caused the market to slip 3.15%. Over the next couple of days, it continued to drop lower and lower and I decided it was time to make good use of some of the cash I have on hand to buy the dip!

I deposited a total of S$1,550 in fresh funds and stocked up on Microsoft & Exxon Mobil. I also added a new stock to my portfolio – Google. I’ve always been a fan of Google, and the only reason I didn’t add it sooner is how it wasn’t a dividend stock until April last year.

I may be a little biased here, but as a marketer by trade, I regard Google as the cornerstone of paid media. You cannot run a full-scale digital campaign without media buys on Google. It supports your campaign in so many ways and helps guide potential customers down the funnel. As Warren Buffett once said, “Never invest in a business you cannot understand.”

And I understand Google’s business to the tee.

But my strong opinion aside, let’s take a look at what the numbers say. Google boasts one of the most robust financial statements I’ve ever seen. It grew its revenue and profit by 14% and a jaw-dropping 36% year-over-year, cementing its position as one of the most profitable public companies in the world… and now, in my portfolio.

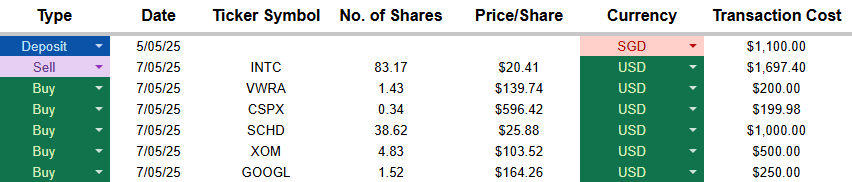

And just earlier this month in May, I made another big move.

I sold all my Intel stocks for US$1,697, realizing a total loss of US$565.

I mean, it was coming. Considering I’m operating a dividend portfolio, Intel is kind of in an awkward position ever since it suspended its dividend payouts.

That aside, despite the losses, I believe that this is a blessing in disguise. There are plenty of stocks in the market that are at great prices based on current valuations. The opportunity cost of holding onto Intel – just to hopefully break even – outweighs the potential gains I could earn elsewhere. The market is full of fundamentally strong companies whose stock prices have been dragged down not because of weak financials, but due to broader economic conditions.

By locking in my loss now and redeploying that capital into said businesses, I’d stand to gain more in the long run.

Which leads me to my buys.

I took the opportunity to buy US$1,000 worth of SCHD (which is down 4.5% since Liberation Day as the Dow Jones Index it tracks has a heavy exposure to industrials and was one of the hardest hit industry by Trump’s tariffs). I also further bought into Exxon Mobil and Google at great prices.

Money well spent, in my opinion!

Overall, I’m very satisfied with my stock purchases over the past couple of months. Which leads me to how my portfolio performed after all these changes!

My Portfolio Performance

Overall Performance vs S&P500

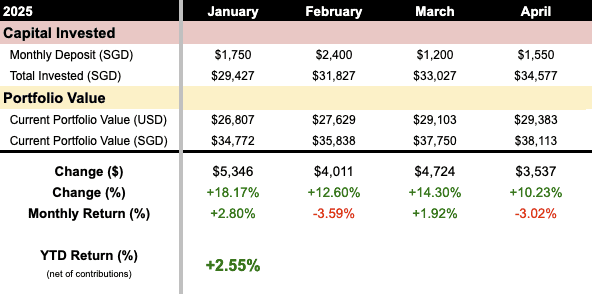

My dividend portfolio is up 10.39% as of the beginning of May. This sounds like a positive note in isolation (at least I’m still in the green, right?) but if you take a look at the whole year so far, it’s clear that my portfolio has seen better days.

As of 31st of January 2025, my dividend portfolio was actually up 18%. This aligned with the rally the broader US market saw in January and the beginning of February with the S&P500 reaching new all-time highs, topping out at 6,147 points.

There was some uncertainty when Trump outlined his tariff plans in March which resulted in a small market sell-off but my portfolio remained resilient and still showed some gains during that month. However, nothing could have prepared us for Liberation Day in April when the market took a big fat dump. My portfolio slumped with the market.

But… as always, how did it do compared to the S&P500?

Year to date, from the beginning of January till the end of April, my portfolio is up 2.55%, net of contributions.

Still, this is a big improvement from the S&P500 which has returned -3.77% in the same time period.

And this is as good a time as ever to point out again that this is the double-edged sword of having a 100% dividend portfolio filled with conservative stock picks. When the market is down in the dumps, my losses will likely be lower, or in this case, it might even be positive. However, when the market is on a bull run as evident from 2024, my returns will be relatively muted in comparison.

Shrinking Returns due to Fx Rates

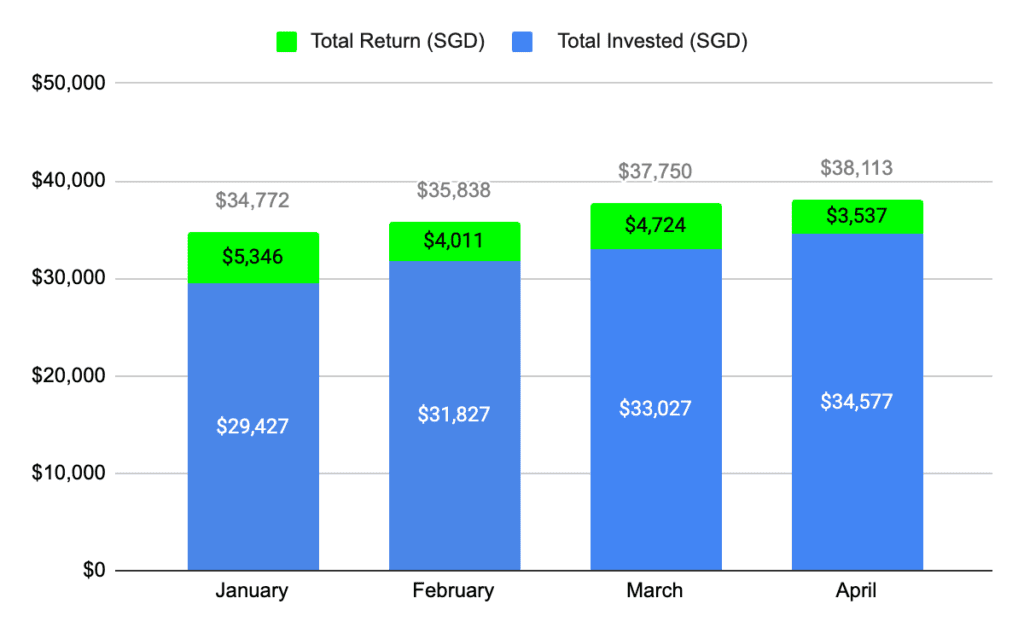

The return on my portfolio has shrunk to only 10.23% in April at S$3,537. It’s been almost a year since I’ve seen the green section of the bar chart get this small.

However, perhaps it’s also worth noting that there’s another reason why my portfolio growth has slowed down even more: the US dollar weakening.

Over the past two years, the USD/SGD exchange rate has hovered around 1.33 to 1.34. But in recent weeks, it dipped to 1.30. That might not sound like much, but for those of us investing in US stocks using SGD, it is a sizeable difference. When the US dollar weakens, the value of your US stocks, denominated in USD, drops when converted back to SGD, even if the stock’s value itself hasn’t changed.

Too complex? Let me give an example.

Say earlier this year in January, I converted S$1,340 to US$1,000 and bought 10 Apple shares at $100 each. Four months later, the stock price hasn’t moved. On paper, I still hold US$1,000 worth of Apple. But if the exchange rate has dropped from 1.34 to 1.30, that US$1,000 is now worth only S$1,300. Just like that, I’ve “lost” S$40 purely due to currency movement—a 3% decline, even though my investment didn’t actually go down in USD terms.

This is the always-present risk of trading stocks in another currency. Many investors forget or overlook it because the USD, as the global reserve currency, has traditionally been relatively stable. But as recent fluctuations show, even minor shifts can makan into your returns.

Performance by Stock

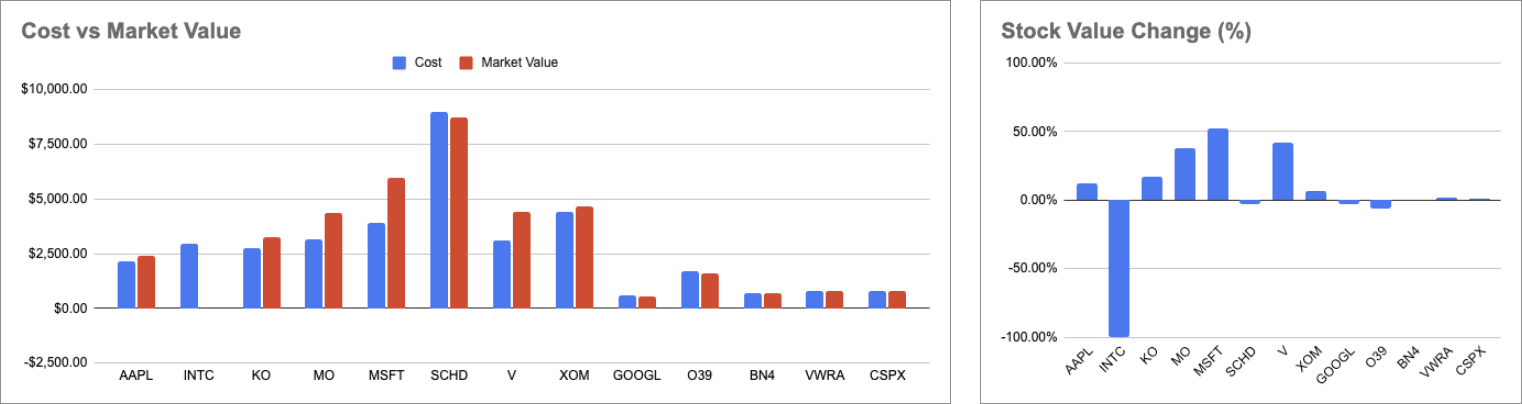

Unsurprisingly, since my portfolio is still up 10%, most of my stocks are still in the green.

P.S. You can ignore INTC here – the reason why its stock value change is -100% is because I sold it. This really shouldn’t be the case – it only shows up this way because I do not currently split unrealised vs realised gains/losses (foolish me thought I would never sell any stock lmao), but that will be fixed by the next DIT1M post!

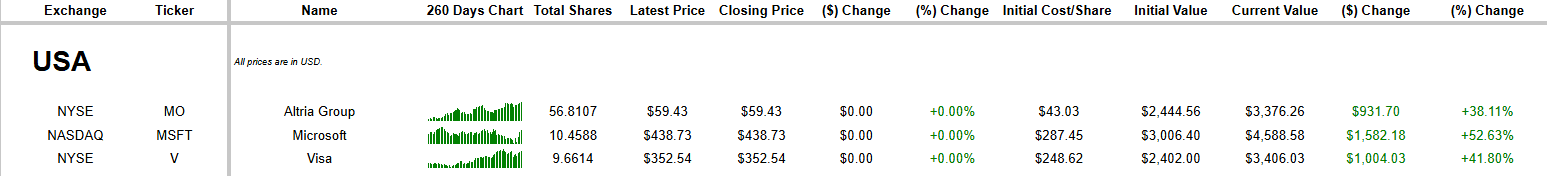

Anyhow, my biggest winners thus far are Microsoft, Visa and Altria with 52.63%, 41.8% and 38.11% respectively. In fact, most of my stocks are still either up slightly or close to breakeven. There are only 3 that are actually in the red: SCHD, Google and OCBC, the latter two mostly a result of them being relatively new purchases.

Let’s start by taking a look at my 3 best performing stocks.

From the 260 Days Chart, these 3 companies experienced some pain from the tariff-induced dip in April, but bounced back almost immediately for somewhat similar reasons – sustained growth even during an unstable period.

Microsoft had another stellar quarter, far beating out analyst expectations. They reported 13% YoY revenue growth which caused investor confidence and the stock price to rally.

Altria’s earnings rose 6% YoY despite declining cigarette volumes, thanks to growth in smoke-free products. Its USA-focused operations also insulated the company somewhat from Trump’s tariffs.

Visa is just Visa. Besides posting a strong 10% YoY revenue growth, it continues its expansion into emerging markets like India and Brazil with large growth potential. Its fee-based, no-credit-risk model is attractive to investors even in a market downturn.

Once again, and this will be a recurring theme throughout the DIT1M series, the stocks that typically do well despite the market trending downwards will always be well-established companies with proven business models and robust cash flow.

The fact that my portfolio is packed full of such companies is the reason why my portfolio remained positive YTD while the S&P500 is down.

Dividend Payouts

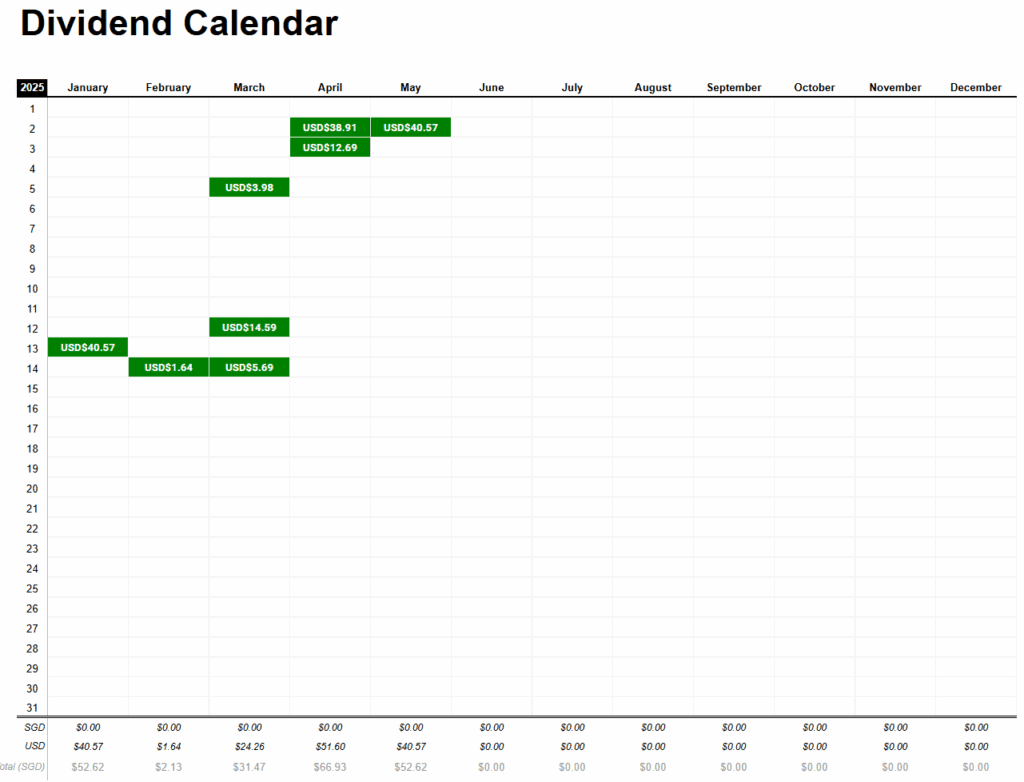

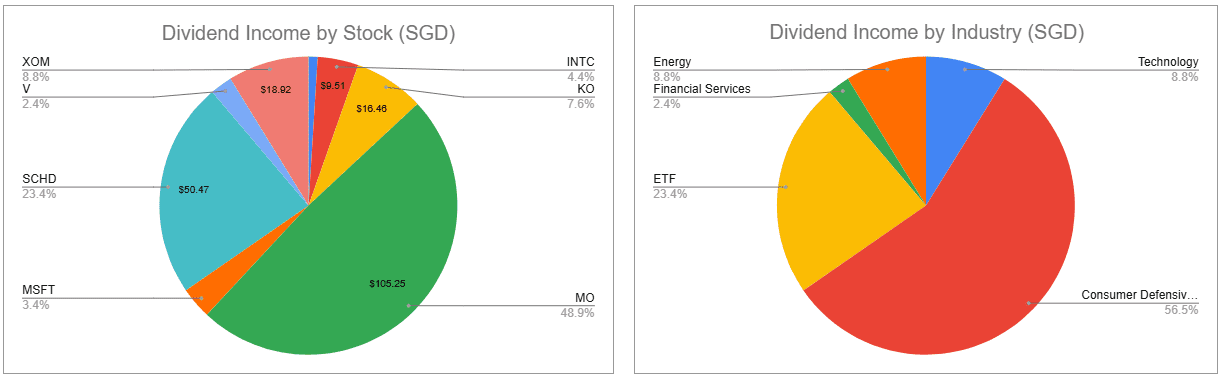

And lastly, dividends! How much have I earned so far this year?

I have received a total of US$165.97 so far, or S$215.28. Of which, S$105.25 (49%) came from Altria, S$50.47 (23.4%) came from SCHD, and S$18.92 (8.8%) came from Exxon Mobil.

It’s not 100% accurate since I have not received the dividend payouts from some new stocks yet and I will continue to DCA which means the dividends I get will continue to grow, but based off the dividends received in my first quarter, it looks like I’ll be receiving North of US$500 this year in dividends. That’s at least 10% more than what I received last year, and the snowball effect is starting to become more and more apparent!

Exciting times ahead.

Concluding Thoughts

I want to start by saying that I was very, very conflicted about investing and DCA-ing too much into the stocks I hold during these 3 months. Maybe not so much for Q1, but I truly struggled last month in April.

And no, it’s not because I was afraid of losing more of my capital if the market continued its downwards trend. I am more than comfortable with throwing money into the markets regardless of how bad of a state it’s in – DCA has numbed me to the ebbs and flows of the markets.

The main reason for my hesitation in investing is… well, I want to keep as much cash on hand as possible.

I covered this in my previous DIT1M post detailing some tweaks to my investment strategy for 2025. Rather than deploying 100% of my monthly investment capital into the market immediately as I’ve always done, I planned to keep a portion of that in cash.

I have largely kept to it. But in light of the unprecedented level of market volatility, I was struck by the urge to keep even more in cash.

Because at this point, I’m genuinely worried about a recession. As a pessimist at heart, I subscribe to the mantra of being safe is better than being sorry. So I want to make sure that I have more cash in my savings account, ready in case of any emergency.

And that’s why you might have noticed that the sum I’m investing has been trending downwards as the months go by.

Unfortunately, I don’t think that’s going to change for the foreseeable future. Until I stock my savings back up to a level that I’m comfortable with, I’m only going to be investing about S$1,000 each month.

Once again, I cover this all in My Financial Breakdown series, so feel free to check it out here.

And that about does it!

Stay safe, stay financially savvy, and most importantly, stay invested.

Until next time, cheers!

Leave a Reply